Deprecated: Creation of dynamic property OMAPI_Elementor_Widget::$base is deprecated in /home2/inancjw3/public_html/wp-content/plugins/optinmonster/OMAPI/Elementor/Widget.php on line 41

Are you interested in starting a retirement account but truly don’t know where to start?

Are you interested in starting a retirement account but truly don’t know where to start?

In today’s article, we will be looking at several basic questions including what retirement accounts are, what risks are involved, and which ones you should consider.

When talking about retirement accounts, there are three main options: Roth IRA, 401k, and 403b. Many people get confused on how, or even if, these are different.

Many people also question why they need to start a retirement account anyway.

Even if you are not planning to retire any time soon, there are many reasons you should consider starting a retirement account today:

-

A retirement account gives you the ability to stop working and enjoy your later years

-

A well-funded account may allow you to retire sooner than you think

-

Compound interest allows younger people to save more over time

-

You won’t have to rely on children, family members, or the government to survive after work

Retirement may seem so far away, and the concept of saving may seem so foreign and difficult that you may be overwhelmed.

Believe me. I understand.

I didn’t even think about retirement until I was married, and when I did, I had no one to help me learn.

The whole process of research and finding answers for myself was a bit daunting.

After a while though, I found that saving for retirement really wasn’t as scary a concept as I originally thought.

What is a retirement account?

At its core, retirement accounts are funds you own that are made up of stocks and bonds from different companies all around the world.

As you put money in, you buy more and more of their companies which gives you more and more money as the company’s value goes up.

Let’s do a quick example to help explain this.

Everyone knows what the company Tesla is. Well, when they first started in 2003, they clearly were not the company they are now.

Everyone knows what the company Tesla is. Well, when they first started in 2003, they clearly were not the company they are now.

Imagine you had a retirement account and you wanted to put 100 dollars in 20 years ago. An option you would have had, was to buy 10 shares of Tesla, at 10 dollars each.

Fast forward to today, and each share is worth about 900 dollars!

You still would own 10 shares of Tesla, but rather than them being worth 10 dollars each, they are now 900. That means your 100 dollars has turned into 9,000!

Clearly these situations do not happen often. But, the story above gives you an idea of what your money can do in a retirement account over time.

How does my money grow?

We addressed this a little bit already, but there are multiple ways your money grows in a retirement account.

First, you can continue to put more and more money in yourself. Obviously, the more money you put in, the larger your account gets. This growth is seen in two different ways.

- As you put money in, you have more money in your account

- The more money you have in your account, the more ability you have for it to grow over time. Pointing to the above Tesla illustration again, if you would have had 20 shares (200 original dollars), rather than 10 (100 original dollars) you would have 18,000 dollars rather than 9,000.

Second, your company can put money in for you. We will discuss this below in more detail when we discuss specific types of accounts.

A third way your money grows in your retirement account is what Einstein referred to as the 8th wonder of the world. Compound interest. I’ll discuss this in more detail below as well.

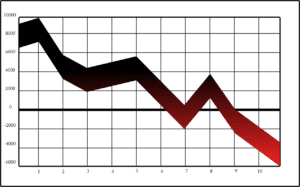

Is there risk in a retirement account?

Like most things, there are risks involved in any retirement account that you choose to have.

The most obvious risk is that you lose money. How does this happen?

Well, there are multiple things that could cause you to lose money, but they all revolve around the health level of the companies you own.

When the economy goes into a downward spiral like we did during Covid, companies suffer.

When everyone stops traveling because there is a dangerous disease out there, then travel companies such as rental car companies, airlines, and hotels all suffer.

Naturally, when they are not making money because their services are not being used, their value drops.

If you own any of these companies, as their value drops, so does the money you have in your retirement account.

Back to the Tesla illustration: if something bad were to happen which caused the stock to drop in price, the 10 shares you have at 9,000 dollars would no longer be worth that. If they are now worth 800 each, you now have 8,000 dollars.

Are there ways to mitigate that risk?

Risk is something we cannot escape, but there are many ways we can help make that risk less. Seatbelts in cars, helmets in sports, and life insurance.

Like life comes with risks, so does your retirement account.

What if we have another pandemic show up? What if a CEO in a major company suddenly passes away?

How do you help shield yourself from the potential major drops in your retirement account?

One of the ways is you can have a financial advisor.

A financial advisor is someone you pay to help manage your money. They typically are much more involved in the stock market and understand when something bad is happening. They can help shield your money when times are tough.

Another vitally important method is diversification.

Diversification is where you have your money in many different funds, so you are not affected by one fund alone.

If you own 10 funds, and 1 of them drops tremendously, you were affected, but only by 1/10th of your account. So, the effects are nearly as bad.

What are the types of retirement funds I can have?

There are many different funds you can have in a retirement account, but I wanted to quickly highly three of the most common.

They are a 401k, a 403b and a Roth IRA.

These pretty much fall into two different categories.

Category 1: Tax Deferred, company plans

Category 1: Tax Deferred, company plans

In this category we find a 401k and a 403b. Both of these accounts are tax deferred, which means that you pay taxes on the money you have in your account after you retire.

This can be a pro and a con depending on your situation. If you are in a high tax bracket now, then this is a benefit, assuming you will be in a lower one when you retire.

Another point of distinction with these accounts is the amount you can put in. Both accounts allow about 20,000 of total contributions each year.

These accounts are also company accounts, meaning that you get them through a company and an individual cannot open them.

A 401k is found in a for profit company, and a 403b is found in a not-for-profit company.

A final point to consider with these accounts is many times they have a company match, meaning that your company will give you free money matching a certain amount that you put in.

Category 2: Tax Exempt, individual plan

A Roth IRA is the most popular plan found in this category. This account is tax exempt meaning you pay taxes before you put the money into your account.

Like the above situation, this has its pros and cons. The biggest pro is found in younger people who are typically in a lower tax bracket than they will be in their older retirement, age.

Also, unlike the 20,000 dollars of contribution in a 401k and 403b, the Roth IRA allows only 6,000 dollars each year.

A final distinction is that a Roth IRA is an individual account. The IRA part stands for Individual Retirement Account, meaning you can open this outside of your company retirement account.

Can I have more than one retirement account?

Yes, you can!

If you work for a for profit company, you can ask them to open you a 401k and then you can go to your financial advisor and ask to start a Roth IRA as well.

The biggest benefit of this is that you are now able to save a combined 26,000 dollars a year between the two of them each year.

Additionally, you are getting the benefit of both tax-deferred growth in your 401k and tax-exempt growth in your Roth IRA.

What is Compound Interest and why should I start my retirement account as soon as I can?

Compound interest  is the number one reason you should start investing as soon as possible. For those who are young investors, compound interest can completely change how much money you have in retirement.

is the number one reason you should start investing as soon as possible. For those who are young investors, compound interest can completely change how much money you have in retirement.

Compound interest works better the longer you allow it to. So, for those of you who are in your 20’s or 30’s, this will be much more effective than those who are in their 50’s or 60’s.

How does it work? I am going to give a simple illustration to help explain this concept.

Let’s say we start an account with 1,000 dollars at 20 years old.

Each year, the stock market gives you a 10 percent return on your money, meaning you gain an additional 10 percent of whatever you have in your account each year. Also, lets assume we do not put any additional money into the account over time.

After year 1, I have 1,000 dollars PLUS 10 percent, or 100 dollars. So at the end of year 1, I now have 1,100 dollars.

Year two does the same thing, but instead of getting a 10 percent return on the original 1,000 dollars that I put it, it is now growing on 1,100 dollars.

So at the end of the year, what do I now have?

Rather than simply gaining 100 dollars like I did the first year, I now gain 110 dollars. Meaning I now have 1,210 dollars after year 2.

Without doing the math all the years, lets look forward to different yearly increments.

- 10 years – After 10 years, my 1,000 dollars would turn into about 2,500 dollars.

- 20 years – After 20 years, my initial 1,000 dollars is worth roughly 6,700 dollars.

- 30 years – Now 30 years later, my 1000 dollars has turned into 17,500 dollars.

- 40 years – If I waited 40 years and took nothing out and added nothing I would have over 45,000 dollars.

Now looking at those numbers, can you see why compound interest may be considered the 8th wonder of the world?

Without doing anything, I was able to turn 1,000 dollars into 45,000 dollars.

The problem with this situation, is that many people do not have 40 years.

If I start a retirement account when I’m 35 and I want to retire at 65, I only have 30 years. So, then my 1,000 dollars can only grow to 17,500.

This reason is why starting as soon as you can and as young as possible is so important.

Hopefully you have seen how easy and simple it is to start saving for retirement.

Does it take a bit of a sacrifice sometimes? For sure! But is the result worth the hard work? Definitely!

Let us know if you have any other questions on retirement accounts, or any positive stories you want to share on how you’ve been able to see these principles worked out in your life!