Deprecated: Creation of dynamic property OMAPI_Elementor_Widget::$base is deprecated in /home2/inancjw3/public_html/wp-content/plugins/optinmonster/OMAPI/Elementor/Widget.php on line 41

A Roth IRA is probably my favorite way for young people to save for retirement.

Why? Because a Roth IRA is one of the most powerful assets a young person can have for their future retirement.

A Roth IRA is a retirement account where you can take out money on a tax-free basis once certain qualifications including age and income have been met.

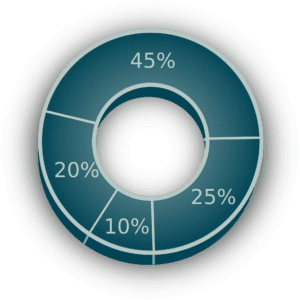

As you can see, there are a number of different aspects to a Roth IRA.

It is a retirement plan, it allows tax-free growth, and there are a number of different qualifications that need to be met to really maximize the benefits it provides.

Below I have answered a number of very common questions concerning a Roth IRA and demonstrate why it would be beneficial for you.

Roth IRA’s provide Tax Free Growth of your retirement money

Tax free growth is exactly what it sounds like: the growth of your money over time avoids taxes.

Tax free growth is exactly what it sounds like: the growth of your money over time avoids taxes.

This aspect of the Roth IRA was the major draw for my wife and I when considering what retirement savings plan we wanted to have.

The reason for that is mainly because when we each opened our own Roth IRA’s we were in low tax brackets. What that meant for us was the taxes we were paying on our income was low.

Looking ahead, I did not know where I would be financially in 10-30 years, but I assumed my income would be higher than it was when I opened the account.

Assuming I’m right, as my income grows so does my tax bracket and thus my taxation level.

Knowing all this information was vital for me because I made a decision to pay taxes with in a lower tax bracket than in a higher tax bracket.

Remember

Most retirement accounts are tax-deferred, meaning when you withdraw the money you then have to pay taxes on it.

With inflation continually rising costs of living, I know I will need more in 30 years when I retire than I currently do now and that will probably push me into a higher tax bracket.

Additionally, I am only paying taxes on a portion of my money!

All the growth I receive in the 30 years of having a Roth IRA are completely tax free.

Let’s say over time I put in 200k but I walk out with 250k. I only paid taxes on what I put in – 200k – and I have no taxes on 50k of income.

In a tax-deferred account, I would have to pay taxes on the entire 250k. Assuming a typical and low 25% tax rate, that is an increase of $12,500 of taxes!

So rather than making 50k I actually only made $37,500!

Once I understood the benefit that tax-free growth offered, I was hooked. But, if things sound too good to be true, then keep reading because there are a number of qualifications you need to meet in order to maximize a Roth IRA.

Roth IRA’s can be made up of many different assets

As with any investment account, there are many different assets you can put your money into. I am not going to go into depth in this article as you can find more information on these on our blog.

To summarize quickly though, the most common investment options in a Roth IRA include mutual funds, index funds, individual stocks, bonds, ETFs, annuities, money market funds, and real estate in the form of REITs.

Roth IRAs do contain risk

As with any investment there are always risks because we are dealing with the market.

When you invest with a Roth IRA you are putting your money into some sort of company where you then either own a small portion of that company (stocks) or you are loaned money in conjunction with your investment (bonds).

As companies do well, the value of the company goes up and naturally your investment rises.

But companies do not always do well.

There are things which occur both internally such as poor decision making and externally such as pandemics that affect how companies perform.

When companies do poorly, their value drops and so does your investment with them.

Do not be scared off because of the risks. Below are two simple ways to mitigate that risk.

First, Diversification is an exceptional way where rather than putting all your money into one fund, you spread it out understanding that while one company may be struggling another may be thriving and you can balance yourself against the ups and downs.

First, Diversification is an exceptional way where rather than putting all your money into one fund, you spread it out understanding that while one company may be struggling another may be thriving and you can balance yourself against the ups and downs.

A second way to help against risks is to have a financial advisor.

Financial advisors literally have the job of managing your money.

You trust a plumber to take care of your plumbing. Trust a financial advisor to deal with your money.

When it comes to money, we all tend to be overly emotional. Your financial advisor will handle your money with much more balance than you will typically.

Roth IRA contributions are limited

As of 2021, the current contribution limit for those who are under 50 is $6000 and for those who are over 50 the number increases to $7000.

These numbers are also continually rising.

From 2015-2018, the limit was $5500 for those under 50 and $6500 for those over 50.

So, for you younger investors, this is a promising trend and something to really take advantage of.

Roth IRA’s have rules on what money can be take out at what time

There is a difference between contributions and growth when it comes to withdrawing money from your Roth IRA.

Your Contributions

Your contributions, or the money you have put in, can be taken out at any time without penalty.

While not advisable, this aspect of a Roth IRA allows you to essentially use it as a savings plan at times where if you are in a crunch and absolutely need money you can take what you have put into your Roth IRA without getting a fee or owing interest.

Your Growth

The growth you accumulate over time is treated much differently than your contributions.

Until you reach age 59 ½, you cannot touch any of the growth without a 10% penalty. Additionally, you must have the Roth for 5 years to receive any growth. There are exceptions to the 5 year rule though:

-

-

- Up to $10,000 in order to buy a first home.

- Up to $5,000 in the year after the birth or adoption of your child.

- The withdrawal is for qualified education expenses.

- The withdrawal is due to disability.

- The withdrawal is for unreimbursed medical expenses in excess of 7.5% of your adjusted gross income for that year.

- The withdrawal is for health insurance premiums while you are unemployed.

- The withdrawal is made after your death to a beneficiary or to your estate

- You decide to take substantially equal payments, which basically locks you into taking at least one distribution per year for at least five years or until you turn 59½, whichever comes last.

- You made the withdrawal when you were a reservist, as defined by the IRS.

- The withdrawal is due to an IRS levy.

-

A rule to remember however, is that it is generally good to not take your money out of any retirement account as the longer it sits, the more compound interest you have.

Can anyone contribute to a Roth IRA?

Not everyone is able to contribute to a Roth IRA.

As with the contribution limits, there are also limits on how much income you can make and still have a Roth IRA.

According to the IRS, in 2023 the current modified adjusted gross income (MAGI) for single tax filers is $153,000. For those married couples out there who file jointly, your MAGI must be under $218,000.

So, if you are not currently making those numbers you can contribute to a Roth IRA, but once you hit those numbers you cannot anymore.

If at one point, you make more than that number, that does not mean that your prior investments simply disappear.

You still own the money you put in up until your salary was too high.

The money you have in there can still grow and be tax-free once it is withdrawn.

Not everyone can open a Roth IRA

The question of who can open a Roth IRA is an important one.

Understanding the tax implications of tax-free growth should really entice everyone to want to open a Roth IRA. And once you consider compound interest, it becomes that much more enticing for young people especially.

There are limitations, however, to who can open up a Roth IRA.

The biggest one is that you need to have earned income.

That means that you cannot open a Roth IRA for your 1-year-old and start investing $6000 a year and let that grow tax-free.

There is such a thing as a custodial Roth IRA though for children who have some form of income such as a part time job, or babysitting.

Additionally, there is such a thing as a spousal IRA where even if one spouse has no income, the other spouse can still contribute to an IRA in the non-working spouse’s name.

Another limit is that contributions must be in accordance to reported income.

So, if the income is not reported to the IRS it will not appear on the income tax return and will not qualify for Roth IRA contributions.

Roth IRA’s have no RMDs

RMDs are required minimum distributions.

These are requirements that some retirement accounts have on the amount of money starting a certain age you need to take out, whether you need it or not.

Let’s say you have enough to cover your costs without taking money out of your 401k and want to just let the money grow for a year. You can not because in a 401k the RMDs start at 70 ½ as of 2021.

To make matters worse, a 401k is tax-deferred.

This means the money the government is forcing you to take out, you are now required to pay taxes on.

In this scenario you lose in two forms: you don’t have the additional time of growth on that money and you have to pay taxes on it.

With a Roth IRA there is no taxes and there is no RMD so if you do not need money one year, you don’t have to take anything out and can let that grow in your tax-free account.

What have you learned? Do you have any more questions that haven’t been answered on this topic? Let us know if the comments below!